Postmedia Network Canada Corp., owner of many of the country’s newspapers, announced in January it was merging newsrooms in cities where it has two papers, eliminating dozens of jobs. Torstar Corp., publisher of the country’s largest circulation paper, closed its printing plant and fired 300. Rogers Media, a unit of Rogers Communications Inc., fired 200 people. The 149-year-old Guelph Mercury shut down its print edition. Some publishers are even suggesting government support is necessary. And that was just in January.

“We’re seeing a further cratering of the daily press,” Ken Doctor, an independent media analyst at Santa Cruz, California-based Newsonomics, said by phone.“The toll that all these years of losses in print advertising has taken is now deadening the enterprises.”

‘Revenue Pressure’

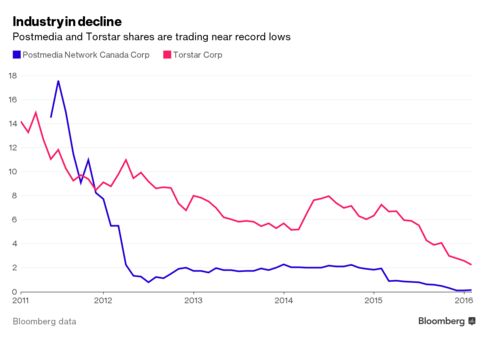

Postmedia, which counts New York hedge fund GoldenTree Asset Management LP among its investors, has sunk to 15 Canadian cents. Credit-rating firms have downgraded Postmedia’s almost C$700 million ($500 million) in debt and questioned its ability to repay the notes when they come due in 2017 and 2018. Mary Beth Grover, an outside spokeswoman for GoldenTree with ASC Advisors LLC, declined to comment on Postmedia.“A material recovery in equity value seems unlikely,” Haran Posner, an analyst at RBC Capital Markets, wrote in a note to clients in January. “Revenue pressure continues unabated, and traction with digital monetization remains elusive.” He cut his price target on the stock to C$0.

Torstar’s market cap has shriveled to C$181 million. Still, its debt is lower than Postmedia’s, with a C$138 million loan due in 2020. Eight analysts have the equivalent of neutral ratings on the stock.

“The market is quite accurately reflecting a harsh but inescapable truth: people do not value the thing we are selling at a price sufficient to cover its costs,” Andrew Coyne, one of Canada’s best-known political commentators, wrote in his own newspaper, the National Post, a Postmedia title.

Representatives of Torstar and Postmedia didn’t return requests for comment.

Billionaire Proprietors

The fallout in Canada mirrors the trend abroad. The U.K.’s Independent newspaper announced last week it would cease print editions in March. In the U.S., total newspaper advertising revenue fell almost 60 percent to $16.4 billion from 2004 to 2014, according to the Pew Research Center.In the U.S., many of the biggest daily papers have gone into the hands of billionaires such as Amazon.com Inc. Chief Executive Officer Jeff Bezos, who bought the Washington Post in 2013. In 2011, Warren Buffett agreed to acquire his hometown paper, the Omaha World-Herald, while John Henry, owner of the Boston Red Sox, bought the Boston Globe from New York Times Co. in 2013.

Charitable Trusts

Canadian papers are much smaller than institutions like the Washington Post and don’t offer the same level of influence, said Pierre-Elliot Levasseur, chief operating officer of the La Presse paper in Montreal, at a Feb. 3 panel discussion on the future of the industry.“I think it’s easier for a Jeff Bezos to come in and say, ‘Look at the impact on democracy I’m going to have across the United States,’” Levasseur said. La Presse stopped its weekday print run late last year and has been lauded for drawing about 460,000 people to its tablet-only edition every week.

Turning the papers over to not-for-profit foundations isn’t the answer either, Phillip Crawley, publisher of the nationally distributed Globe and Mail, said at the event. He pointed to the U.K.’s Guardian newspaper, which is funded by a charitable trust, as a prime example. It’s admired for its journalism but is losing money, while the Daily Telegraph makes money in the same market, Crawley said.

Tablet Bet

The Globe and Mail, which heralds itself as the country’s paper of record and has used a paywall to push its more affluent reader base to sign up for subscriptions, projects that print advertising revenue will still be double digital revenue though 2019, Crawley said.Torstar’s Toronto Star experimented with a paywall for less than two years. It’s since built an iPad-only edition developed in conjunction with La Presse. Star Publisher John Cruickshank declined to comment at the event on how much revenue the tablet app is generating.

Another element unique to Canada is the presence of the Canadian Broadcasting Corporation, which received about C$1.04 billion in government funding in the fiscal year ended March 2015.

“I resent the fact that I’m competing with something I’m paying for with my own taxpayer dollars,” Crawley said.

Please share this

No comments:

Post a Comment