The million-dollar view from this 28th floor corner condo at the Ritz-Carlton Hotel and Residences is beyond one of a kind.

The CN Tower is so close you can almost touch it from the kitchen table and the setting sun lights up the living room’s wall of west-facing windows.

But for a very long time, no one was buying.

This “mansion in the sky” took 180 days to sell. And it’s far from alone.

Some 29 of The Ritz’s 161 granite-and-glass clad condos have been for sale for months now on MLS. And that’s not counting 12 units the developer is still marketing in the 52-storey project, the first of four five-star hotel-condo developments to hit the Toronto market.

That, combined with the sizable number of Trump International condos investors have been trying to unload in the underground “assignment” market, is boosting buzz about how fierce the competition could get when Trump officially opens its doors Jan. 31, followed by the Shangri-La and Four Seasons residences later this year.

“I think we’re seeing already with the Ritz that there’s not a lot of demand for resale (condos) in this price range,” says realtor John Pasalis, who has been watching this sector closely and is concerned about an oversupply of luxury condos.

“In some ways this (the number of Ritz and Trump units now for sale) is the sign of a market that was very speculative and is reaching a point where investors are starting to realize that just because they bought (early) doesn’t mean they are going to make an easy buck.”

That 2-bedroom, 28th-floor condo, for instance, was first listed back in July for $1.85 million — about $950 a square foot. Its maintenance fees alone are $1,800 a month.

It was later reduced to almost $1.6 million or about $825 a square foot. It sold conditionally this week for an undisclosed amount.

There’s no doubt it went for substantially less than the $1,100 per square foot the developer is asking for their 12 remaining units.

Condos sold in the pre-construction phase of The Ritz averaged $925 per square foot, says condominium research firm Urbanation. But a few went for as little as $700 or $750 per square foot says realtor Barbara Lawlor of Baker Realty who is overseeing sales for Ritz developers Graywood Developments and Cadillac-Fairview.

“Some people invested believing they would make great profits and now they’re trying to realize that,” which explains why there are so many units now listed on MLS, says Lawlor.

One investor, she noted, paid less than $2 million for their 2,400 square-foot two-bedroom condo and is now asking almost $3 million. It’s still for sale.

Five units have sold since July on MLS and their owners have pocketed $300,000 to $440,000, she said. Three more deals are pending.

“The developer would prefer if they (lower priced units) were not for sale on the MLS,” she added, “but there’s not much we can do.”

The Ritz has a “huge advantage,” says Lawlor, being the first of the five-stars to be opened to the public by dignified doormen last February on Wellington St., steps from Toronto’s entertainment district.

The 379-unit Trump International opens next week in the financial district, followed by the Living Shangri-La on University Ave. and the Four Seasons residences in Yorkville later this year.

While all the projects appear to be at least 80 per cent sold out, some Trump investors have already tried to back out of contracts or “assign” their units to new buyers through realtor word of mouth since they can’t be listed on MLS until the building actually opens and they take possession.

Dozens more condos are expected to hit the market as the remaining five-star projects open, although few listings are expected at the Four Seasons, the favourite, it seems, of Toronto’s downsizing rich.

But Lawlor says she expects any resales will be consistent with the 18 to 20 per cent of listings she routinely sees when a new condo project gets built as buyers try to cash out or find their personal situation has changed during the three to five years of construction.

The great unknown here, housing experts say, is whether there are enough buyers able to cough up a million dollars plus for all those luxe condos.

“The market will find its level, but the next year will be interesting because never before has there been so much luxury product come into the market at the same time,” says Lawlor.

“I believe there will be buyers in the Toronto market for these listings.”

So does realtor Andy Taylor, senior vice president of sales for Sotheby’s International, who is working with two potential Ritz buyers right now.

“It’s partly because this is new to the city — five-star living is in it’s infancy in Toronto. I think the minute people experience what it’s like to walk through those doors, we will find more buyers.”

http://www.moneyville.ca/article/1121611--ritz-carlton-five-star-condos-proving-a-tough-sell

Toronto's News, Free Daily News from the Toronto Star, Globe and Mail, Toronto Sun, National Post, CP24, CTV, Global, 640toronto, CFRB, 680 News

Thursday, January 26, 2012

Tuesday, January 24, 2012

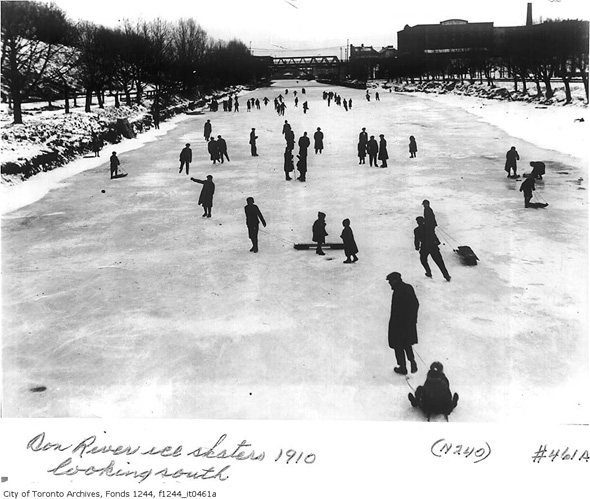

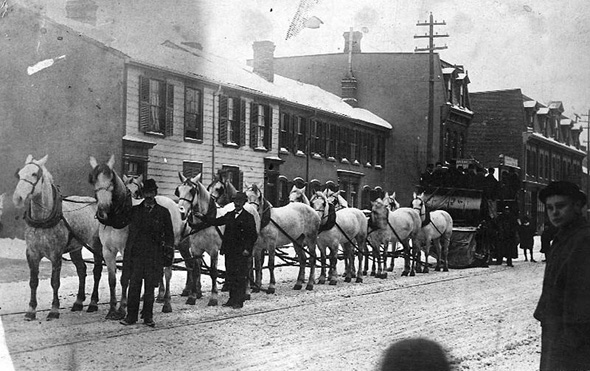

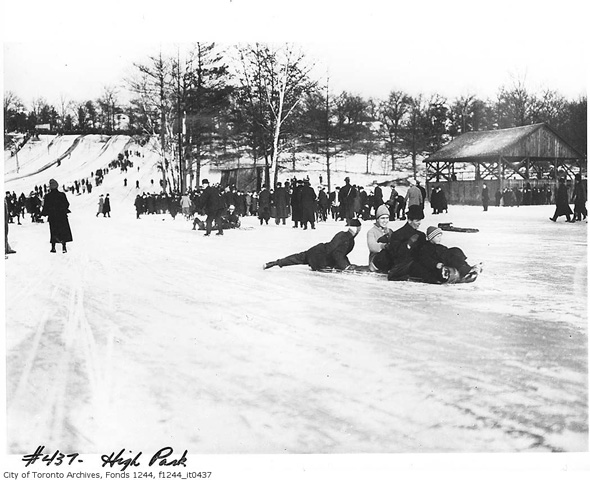

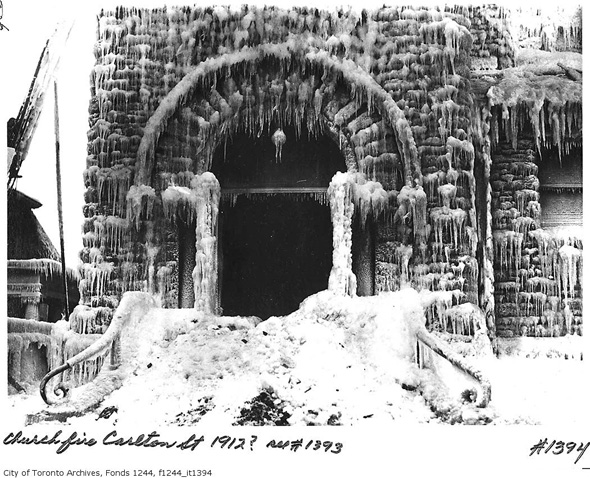

Vintage photographs of winter in Toronto

Vintage

photographs of what winter used to look like in Toronto make up only a

small portion of the images collected in the many historical posts previously published

on this site. Although there's plenty to choose from in the City's

digitized archival holdings, unless one is specifically looking for

winter scenes, he's likely to pass them over in favour of those images

that present the city without the presence of snow.

Vintage

photographs of what winter used to look like in Toronto make up only a

small portion of the images collected in the many historical posts previously published

on this site. Although there's plenty to choose from in the City's

digitized archival holdings, unless one is specifically looking for

winter scenes, he's likely to pass them over in favour of those images

that present the city without the presence of snow.The funny thing about this is that the experience of winter has always been a crucial aspect of life in Toronto. One might say it's part of the reality of living here. So why the relative scarcity of such images? It stikes me that something akin to the pathetic fallacy might be at work here in some way: snow = forgetting. In blanketing the city, snow obscures the very buildings and streets that (archival) photos aim to shed light upon.

There are pragmatic reasons as well. Carting around a view camera and wooden tripod in two feet of snow and sub-zero temperatures just isn't much fun. The majority of wintery photographs that survive from Toronto's past thus tend to be specifically dedicated to capturing winter itself, rather than subject matter that could just as well have been shot during the warmer months. What one finds below, then, is images of skating, tobogganing, iceboats, sleds and snowstorms — in other words, people trying to make the best of what was surely an uncomfortable season.

PHOTOS

12 horse team pulling snow sweeper Ca. 1890s

That's a lot of coal! Skyline 1904

Sleighing at Queen's Park 1906

Snowy University Avenue 1908

High Park late Ca. 1908-1910

Ice fishing, Centre Island 1909

Apparently a huge toboggan at Christie Pits 1909

Apparently a huge toboggan at Christie Pits 1909

Parking at the Old City Hall quadrangle 1910

Kew Beach 1911

Snowball fight, Rosedale Ravine 1912

A propellor sled! Toronto Bay 1912

Pier, Eastern Gap 1912

Ice-encased church post-fire on Carleton Street 1912

Ice-encased church post-fire on Carleton Street 1912

Ice boats 1912

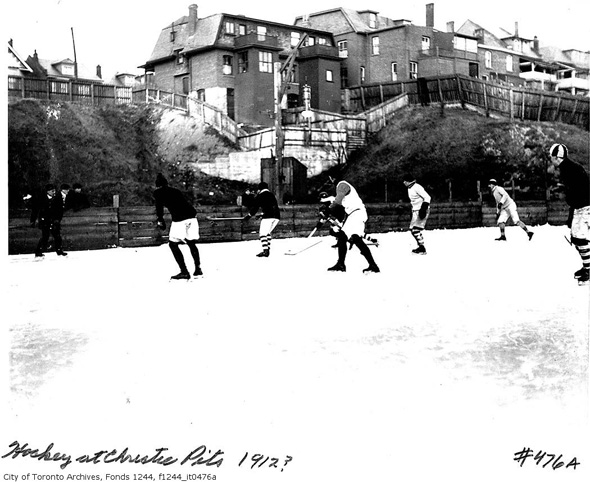

Hockey at Christie Pits 1912

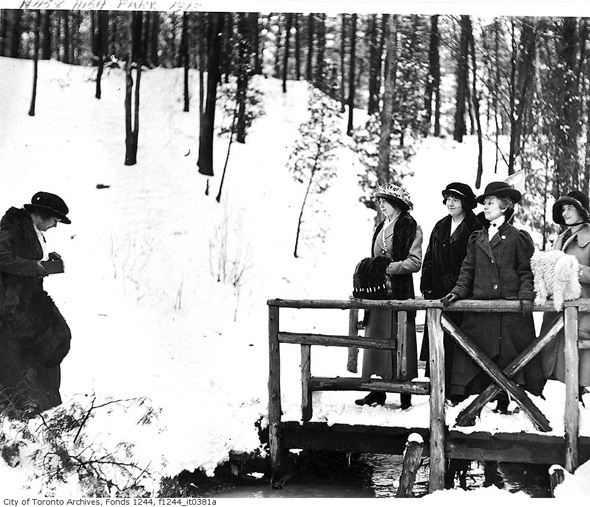

High Park 1913

High Park tobogganing 1914

High Park toboggan runs 1914

Wychwood barns 1915

Wychwood barns 1915

Trinity College Gates 1916

Bloor Viaduct under construction 1917

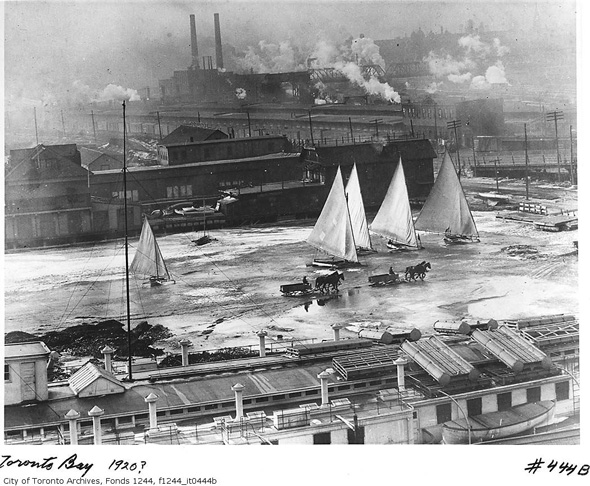

Toronto Bay 1920

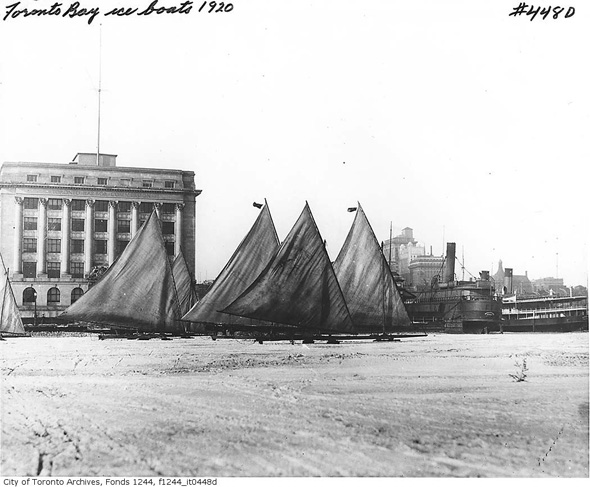

Ice boats in front of Harbour Commission Building 1920

Glen Road bus 1923

Snow plough 1924

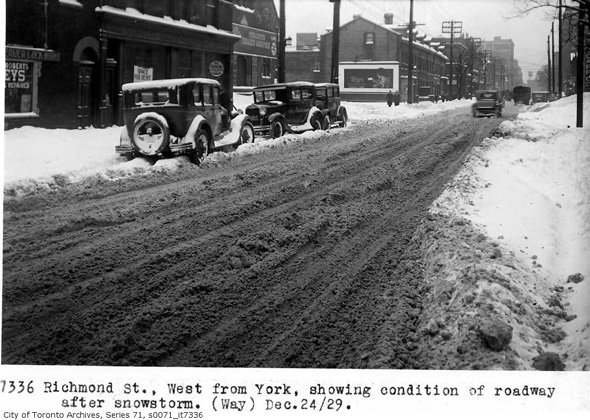

Snowstorm on Richmond Street 1929

Snowstorm on Richmond Street 1929

Snowy Casa Loma 1936

Snow blower at night 1943

The great snowstorm of 1944

The great snowstorm of 1944

Snowstorm at John & King 1961

Snowstorm at John & King 1961

Monday, January 23, 2012

Levy: Former mayors oppose home sales

With the dust not yet settled from last week’s budget brou-ha-ha, City Hall’s next battle will heat up Tuesday over a plan to sell off 675 Toronto housing authority homes, most of which are sitting in disrepair and require significant outlays of cash to fix them.

On one side are a posse of former Toronto mayors, the leftist councillors plus many of their useful idiots in the mushy middle and the usual poverty/tenant activists.

On the other is the new business-minded, far more transparent and realistic senior management of TCHC and a business-like board that recognizes money is not set to drop from the sky to repair the housing authority’s decrepit portfolio of 58,500 units.

The plan to use the sale of the homes to raise a much-needed $222-million towards the TCHC’s current $650-million backlog of repairs was approved by the TCHC board at their Oct. 22 meeting of last year.

The plan must first be approved by council and then by Ontario Housing Minister Kathleen Wynne. The sale of another 22 TCHC homes has been awaiting approval from the housing ministry since last May.

The current plan before executive committee proposes the sale of 633 single family houses across the city — 56 of which are vacant — and another 31 property houses which were purchased by the former city of Toronto for non-housing uses (for parks, to extend roads, etc.) A further 11 Single Housing Opportunity Program (SHOP) homes are also up for sale.

The report to executive committee, not surprisingly, says all of these single family homes are “more costly to maintain” than the rest of the TCHC’s portfolio of 58,500 units.

Acting CEO Len Koroneos told me last week that the $222-million they expect to get from the sale — proceeds that are net of real estate and outstanding mortgage costs — are based on 2008 MVA figures and are probably conservative.

He said many of the homes are more than 40 years old — some are as much as 80 years old — and have a long list of repair needs ranging from decrepit kitchen cabinets and furnaces to ceilings and roofs that have been eaten through by raccoons.

He noted that the sales, once approved by council and the province, will be phased in over three to five years to allow them to find “suitable alternate accommodation” for the impacted tenants.

“Before we displace people, we will give them adequate notice and pay their moving costs,” he said.

Yet as much sense as this sale makes to me, four former old city of Toronto mayors — David Crombie, John Sewell, Art Eggleton and Barbara Hall — have written to Mayor Rob Ford and to council to oppose the sale.

The letter from Crombie, Sewell and Eggleton — e-mailed to council by Marlene Riley of the Toronto Lands Corp. — claims that the sale will force the tenants impacted into segregated communities.

Sewell acknowledged in an interview that “money has to be found” to repair the rest of the TCHC portfolio and thought city officials should “re-engage” in negotiations with the feds and the province to get funding.

Barbara Hall, who wrote to council in her role as grand poobah of the Ontario Human Rights Commission, also expressed concerns that housing would be removed at a time when there is a long waiting list.

She noted that those “vulnerable people” impacted by these sales decisions often come under the OHR Code and need to be considered.

(It is so easy for all of these mayors to comment considering their jurisdiction over social housing was relatively minimal. In their day, Metro and the province handled most of it.)

Nevertheles, Koroneos said the feds and province haven’t even talked about uploading the units, let alone providing funding for repairs — and the sell-off of their homes is the “only option.

“We are trying to do the greatest amount of good for the greatest amount of people in our units at no cost to taxpayers,” he said.

Mark Towhey, one of the mayor’s senior staffers, said for the first time ever, the TCHC has come forward with a credible financial plan to “address the quality of life in (all) units.”

Asked if he expected a fight at council over the sale, Ford called it a case of simple “common sense.”

“I don’t consider it a fight,” Ford said. “It is going to help people in housing, it has to go to capital repairs.”

On one side are a posse of former Toronto mayors, the leftist councillors plus many of their useful idiots in the mushy middle and the usual poverty/tenant activists.

On the other is the new business-minded, far more transparent and realistic senior management of TCHC and a business-like board that recognizes money is not set to drop from the sky to repair the housing authority’s decrepit portfolio of 58,500 units.

The plan to use the sale of the homes to raise a much-needed $222-million towards the TCHC’s current $650-million backlog of repairs was approved by the TCHC board at their Oct. 22 meeting of last year.

The plan must first be approved by council and then by Ontario Housing Minister Kathleen Wynne. The sale of another 22 TCHC homes has been awaiting approval from the housing ministry since last May.

The current plan before executive committee proposes the sale of 633 single family houses across the city — 56 of which are vacant — and another 31 property houses which were purchased by the former city of Toronto for non-housing uses (for parks, to extend roads, etc.) A further 11 Single Housing Opportunity Program (SHOP) homes are also up for sale.

The report to executive committee, not surprisingly, says all of these single family homes are “more costly to maintain” than the rest of the TCHC’s portfolio of 58,500 units.

Acting CEO Len Koroneos told me last week that the $222-million they expect to get from the sale — proceeds that are net of real estate and outstanding mortgage costs — are based on 2008 MVA figures and are probably conservative.

He said many of the homes are more than 40 years old — some are as much as 80 years old — and have a long list of repair needs ranging from decrepit kitchen cabinets and furnaces to ceilings and roofs that have been eaten through by raccoons.

He noted that the sales, once approved by council and the province, will be phased in over three to five years to allow them to find “suitable alternate accommodation” for the impacted tenants.

“Before we displace people, we will give them adequate notice and pay their moving costs,” he said.

Yet as much sense as this sale makes to me, four former old city of Toronto mayors — David Crombie, John Sewell, Art Eggleton and Barbara Hall — have written to Mayor Rob Ford and to council to oppose the sale.

The letter from Crombie, Sewell and Eggleton — e-mailed to council by Marlene Riley of the Toronto Lands Corp. — claims that the sale will force the tenants impacted into segregated communities.

Sewell acknowledged in an interview that “money has to be found” to repair the rest of the TCHC portfolio and thought city officials should “re-engage” in negotiations with the feds and the province to get funding.

Barbara Hall, who wrote to council in her role as grand poobah of the Ontario Human Rights Commission, also expressed concerns that housing would be removed at a time when there is a long waiting list.

She noted that those “vulnerable people” impacted by these sales decisions often come under the OHR Code and need to be considered.

(It is so easy for all of these mayors to comment considering their jurisdiction over social housing was relatively minimal. In their day, Metro and the province handled most of it.)

Nevertheles, Koroneos said the feds and province haven’t even talked about uploading the units, let alone providing funding for repairs — and the sell-off of their homes is the “only option.

“We are trying to do the greatest amount of good for the greatest amount of people in our units at no cost to taxpayers,” he said.

Mark Towhey, one of the mayor’s senior staffers, said for the first time ever, the TCHC has come forward with a credible financial plan to “address the quality of life in (all) units.”

Asked if he expected a fight at council over the sale, Ford called it a case of simple “common sense.”

“I don’t consider it a fight,” Ford said. “It is going to help people in housing, it has to go to capital repairs.”

Sunday, January 22, 2012

Stop rink waste: Mammoliti

TORONTO - Toronto has more artificial ice rinks than any other city in the world, a feat I am extremely proud of as the Chair of the Community of Development and Recreation.

The 2012 Recommended Operating Budget for Parks, Forestry and Recreation included savings of 0.260 million as a result of closing 10 out of 22 stand-alone arenas during off-peak daytime hours (7AM to 4PM from Monday to Friday) and eliminating 7.5 related positions. However, at City Council on January 17th, 2012 a motion was adopted which ensured our City funds these ice rinks during off-peak hours.

City staff have done research and chose specific rinks for closure for a reason. Parks, Forestry and Recreation staff made it clear that the usage of these ice-rinks during off-peak hours was 8%. Thus, 92% of the time nobody was using these rinks during the hours of 7AM – 4PM. These ice rinks are open from November till March meaning we could have saved $260,000 for 5 months of operation.

On average we spend $52,000 a month to maintain these arenas for 9 hours. The remaining arenas that would remain open during the daytime off-peak hours have sufficient capacity to accommodate the permits that would have been displaced. Councillors’ would not support temporarily closing ice rinks if it was not justified. It just isn’t intelligent, no service or business would open at 7:00AM if they had only three individuals using it, especially when they could save $260,000.

As a consequence, the City of Toronto has been placed in a position in which workers are being sent to sites with no work to do as stated by City staffs’ recommendation to eliminate 7.5 positions. As a result, the City and the taxpayer will bear the brunt of such costs.

Those who supported this motion are clearly in favour of wasting taxpayers’ dollars. It is careless spending such as this which has led us to the current predicament. The cuts had to take place due to unmonitored, uncontrolled and reckless spending. By continuing to fund ice rinks that are under-used some Councillors are exemplifying that they just don’t get it. Reckless spending needs to be stopped.

As Chair of the Ice Rink Infrastructure Task Force I am well versed in the City of Toronto’s needs in regards to great demand for prime time ice. The City is attempting to meet the needs of its diverse citizens, community organizations and associations through providing quality time and facility space. However, the actions, which occurred at City Council adversely impacts Parks, Forestry and Recreation. We will still succeed in meeting the citizens’ demands for prime time ice. I just want to emphasize and raise attention to the issue that our budget was negatively affected.

In the days since this motion was adopted my office has received several calls and e-mails agreeing with my stance on the issue. The citizens of Toronto recognize that unneeded expenses need to be stopped. I hope that citizens contact their Councillor who voted in favour of funding these ice rinks during off-peak hours and make it clear that they wrongfully cost the taxpayers $260,000.

The 2012 Recommended Operating Budget for Parks, Forestry and Recreation included savings of 0.260 million as a result of closing 10 out of 22 stand-alone arenas during off-peak daytime hours (7AM to 4PM from Monday to Friday) and eliminating 7.5 related positions. However, at City Council on January 17th, 2012 a motion was adopted which ensured our City funds these ice rinks during off-peak hours.

City staff have done research and chose specific rinks for closure for a reason. Parks, Forestry and Recreation staff made it clear that the usage of these ice-rinks during off-peak hours was 8%. Thus, 92% of the time nobody was using these rinks during the hours of 7AM – 4PM. These ice rinks are open from November till March meaning we could have saved $260,000 for 5 months of operation.

On average we spend $52,000 a month to maintain these arenas for 9 hours. The remaining arenas that would remain open during the daytime off-peak hours have sufficient capacity to accommodate the permits that would have been displaced. Councillors’ would not support temporarily closing ice rinks if it was not justified. It just isn’t intelligent, no service or business would open at 7:00AM if they had only three individuals using it, especially when they could save $260,000.

As a consequence, the City of Toronto has been placed in a position in which workers are being sent to sites with no work to do as stated by City staffs’ recommendation to eliminate 7.5 positions. As a result, the City and the taxpayer will bear the brunt of such costs.

Those who supported this motion are clearly in favour of wasting taxpayers’ dollars. It is careless spending such as this which has led us to the current predicament. The cuts had to take place due to unmonitored, uncontrolled and reckless spending. By continuing to fund ice rinks that are under-used some Councillors are exemplifying that they just don’t get it. Reckless spending needs to be stopped.

As Chair of the Ice Rink Infrastructure Task Force I am well versed in the City of Toronto’s needs in regards to great demand for prime time ice. The City is attempting to meet the needs of its diverse citizens, community organizations and associations through providing quality time and facility space. However, the actions, which occurred at City Council adversely impacts Parks, Forestry and Recreation. We will still succeed in meeting the citizens’ demands for prime time ice. I just want to emphasize and raise attention to the issue that our budget was negatively affected.

In the days since this motion was adopted my office has received several calls and e-mails agreeing with my stance on the issue. The citizens of Toronto recognize that unneeded expenses need to be stopped. I hope that citizens contact their Councillor who voted in favour of funding these ice rinks during off-peak hours and make it clear that they wrongfully cost the taxpayers $260,000.

Toronto cops stock up on cruisers

With Ford’s decision to cancel production of full-size Crown Victorias, Toronto Police filled a rooftop with enough of the cars to last up to three years.

The 300 cruisers cost about $5 million, but the bulk purchase saved taxpayers $1.5 million, according to Const. Tony Vella.

Built only in St. Thomas until production stopped last September, the last North American rear-wheel-drive V-8s were “found to suit our purposes,” Vella said.

Once available privately, “Crown Vics” were produced exclusively for fleet orders in recent years.

Most cruisers were branded “Police Interceptor,” with heavier-duty engines, transmissions and electrical systems, plus revamped steering and rear suspensions.

Big patrol cars were once common, including the Dodge Diplomat, Ford Galaxie, and Chevrolet Caprice.

Toronto Police last bought Caprices in the late 1980s. General Motors stopped producing them in 1996.

Except for special squads that use SUVs and vans, plus tests with other vehicles including mid-size Chevrolet Impalas, Crown Victorias remain Toronto’s patrol car of choice.

The stockpiled white Crowns on the roof of the Traffic Services building in Liberty Village will eventually replace old cruisers. Until then, they are checked and started periodically.

Cop cruisers typically last up to three years before they’re stripped of equipment and sold.

The OPP uses Crown Victorias and SUVs while regional forces have a variety of North American vehicles.

There have been alternatives to the big gas-guzzlers, but smaller GM and Chrysler four-door cars left some officers complaining about gear-jammed interiors, low ceilings, front-wheel drive handling and restricted visibility.

Since Ford’s 2009 announcement of the Crown Vic’s demise, fierce competition began for cruiser markets.

General Motors reprised an old brand in 2010 when it unveiled a V-8 patrol car. Made in Australia starting last year, the new Caprice bears a close resemblance to the GM-related Holden Commodore.

Some U.S. forces ordered the 2011 Holden Statesman. The RCMP use Jaguars and Land Rovers in B.C.

In mid-2010, Chrysler unveiled a 2011 Charger Pursuit, available with V-6 or V-8 motors. Many North American forces use Dodge Magnums and low-slung Chargers.

The 300 cruisers cost about $5 million, but the bulk purchase saved taxpayers $1.5 million, according to Const. Tony Vella.

Built only in St. Thomas until production stopped last September, the last North American rear-wheel-drive V-8s were “found to suit our purposes,” Vella said.

Once available privately, “Crown Vics” were produced exclusively for fleet orders in recent years.

Most cruisers were branded “Police Interceptor,” with heavier-duty engines, transmissions and electrical systems, plus revamped steering and rear suspensions.

Big patrol cars were once common, including the Dodge Diplomat, Ford Galaxie, and Chevrolet Caprice.

Toronto Police last bought Caprices in the late 1980s. General Motors stopped producing them in 1996.

Except for special squads that use SUVs and vans, plus tests with other vehicles including mid-size Chevrolet Impalas, Crown Victorias remain Toronto’s patrol car of choice.

The stockpiled white Crowns on the roof of the Traffic Services building in Liberty Village will eventually replace old cruisers. Until then, they are checked and started periodically.

Cop cruisers typically last up to three years before they’re stripped of equipment and sold.

The OPP uses Crown Victorias and SUVs while regional forces have a variety of North American vehicles.

There have been alternatives to the big gas-guzzlers, but smaller GM and Chrysler four-door cars left some officers complaining about gear-jammed interiors, low ceilings, front-wheel drive handling and restricted visibility.

Since Ford’s 2009 announcement of the Crown Vic’s demise, fierce competition began for cruiser markets.

General Motors reprised an old brand in 2010 when it unveiled a V-8 patrol car. Made in Australia starting last year, the new Caprice bears a close resemblance to the GM-related Holden Commodore.

Some U.S. forces ordered the 2011 Holden Statesman. The RCMP use Jaguars and Land Rovers in B.C.

In mid-2010, Chrysler unveiled a 2011 Charger Pursuit, available with V-6 or V-8 motors. Many North American forces use Dodge Magnums and low-slung Chargers.

Toronto real estate safe as houses

TORONTO - Eileen Campbell looks around her lovely 900-sq.-ft. downtown Toronto condo and sighs.

For the past seven years, the chef has made her two-bedroom corner unit at 550 Front St. W. really feel like home by gutting the kitchen, installing a quartz counter top and opening up the space.

Campbell, 65, moved west after living in a home in the Beach area, loving that she no longer has to maintain a backyard or shovel snow off a driveway.

And being a foodie, she’s close to hip restaurants along the King West strip. She’s also able to enjoy summers out in her terrace with her little chihuahua — that is, when there isn’t a dust storm from nearby construction of other condos going up along the waterfront.

But retirement is nearing for Campbell and she’s made the decision move again — to a house in the Niagara Region.

Economists forecast Toronto’s booming condo market will experience a crisis in a few years with too much supply and sagging demand, starting in 2013.

So for Campbell, this is the ideal time to sell and is listing her property at $449,800.

“In my mind, if there is that much inventory for people to choose from, would they choose (to buy) a brand-new place or a place that’s been here for a while?” she said. “I don’t want to wait to find out. I’d rather get my equity out now and move onto something else.”

Several of Canada’s biggest banks recently warned about a possible correction in the housing market. Still, prices of homes keep rising, according to the Toronto Real Estate Board (TREB) with mortgage rates remaining low, hovering around 3%.

In fact, the Economist recently declared Canada as one of nine countries where “home prices are overvalued by about 25% or more” and among four countries where prices are in line with those in the United States “at the peak of its bubble.”

While many fear Toronto’s real estate bubble is on the verge of bursting, analyst are cautioning buyers and sellers to relax.

“I do not believe that Toronto, as a whole, is in a bubble,” explains Don Campbell, president of the Real Estate Investment Network. “I think it’s more like a balloon where the air is going to start leaking out.”

Housing will continue to stay strong throughout downtown communities and surrounding areas, such as Leslieville and the Junction, where many newcomers may choose to buy homes because downtown is too expensive, Campbell said. Where there is trouble is the new condo market.

“I believe we’re going to feel an over supply in 2013 because we’ve got a record number of condos coming onto the market in 2012,” he says. “In addition, there have been a lot of development applications put forward to the City of Toronto at the end of December. We’re already starting to see a slowdown in foreign money going into the condo market.”

When those who bought new condos are handed their keys with the intention of immediately flipping the property, they’ll be others doing the same.

“Therefore, you’re going to have an oversupply of the situation come on,” Campbell adds. “That oversupply won’t last for a long time — not like the U.S. — but it’s going to keep a real cap on value.”

Craig Alexander, chief economist for TD Canada Trust, says many first-time home buyers jumped into the real estate market in 2009 because of record-low mortgage rates. The market remained strong in 2010, but it began moderating in 2011.

“I think in the coming year we’ll see the housing market pretty flat,” he predicts.

“I don’t see the likelihood of a major correction coming this year. I do think there’s over-valuation in the market, but I don’t see a major housing bubble in the GTA. I think when we see interest rates rise, we’ll see housing prices decline but it won’t be a dramatic decline.”

The big risk to the so-called bubble occurs when there’s a sharp spike in unemployment or as interest rates shoot up. Alexander figures interest rates should increase by a modest rate — 1% in 2013 and 1% in 2014.

“Torontonians need to be careful not to over-extend themselves because eventually, interest rates will rise,” he said. “I feel like the little boy that cried wolf because every year I tell people that rates could rise and then they don’t. But I always have to remind people that the wolf does show up at the end of the story.”

Richard Silver, the president of the Toronto Real Estate Board (TREB), said the seller’s market has transitioned to a balanced market with more listings now than a year ago.

“Anything that came on the market had multiple offers and buyers had to get a lot more aggressive,” he said.

“They had to get their ducks in a row — like their financing and building inspections and had to make decisions quickly. Now, buyers have more time. They can look around.”

With the new condo sales, it really depends on what is happening in foreign investors, Silver said.

“A lot of (condo deals) happen offshore … that’s a really big part of the market,” he said. “We’re very lucky in Toronto. Right now, there’s a lot of shovels going in the ground. I look at New York and there’s hardly anything being built. Yet, in Toronto, it’s gangbusters.”

TREB had second-best year on record for sales in 2011 with 89,347 — up 4% from the previous year.

According to the real estate board, $465,000 is the average price of a single-family home in 2011. So, what does that get you in the GTA? Surprisingly, not as much as you’d think.

In Toronto, that amount will get you a 800-900-sq.-ft. condo, though it will be renovated and in move-in condition.

“There was only one house that turned up (on a search) – it was on Dufferin, there were no pictures, so it would’ve been an absolute fixer-upper for $465,000,” said Kimball Sarin, a broker with Bosley Real Estate, who has been in the real estate business for a decade. “Whereas this price range for condos, you could get a decent space in move-in conditions. You can sometimes get two bedrooms.”

If you’re looking for a house in Toronto, you’ll likely have to scour Leslieville or the Junction area — places that are roughly 20 minutes outside the downtown core.

“I find people who are looking for only condos don’t even want to discuss moving outwards, they just want to be downtown,” Sarin said. “They’re mostly younger people, 20s-30s typically, first-time buyers. We’re also getting a lot of empty-nesters. People that are going to be selling a larger house.”

Catherine McIsaac, a Sutton Group sales representative, said parts of the 905 are slowly catching up with the rising prices in Toronto. The only detached property available in Oakville was a 1,500-2,000-sq.-ft. three-bedroom family home in the West Oak Trails with an unfinished basement.

In Mississauga, the Marilyn Monroe building — a unique curvy condo tower at 50 Absolute Ave. near Square One — fits in the $465,000 budget. That price fetches a two-bedroom plus den, 997-sq.-ft. unit which costs about $428,400.

With an influx of 100,000 people to the GTA each year, many renters are moving into condos purchased by offshore investors because there aren’t many developers building rental properties anymore.

“There are several new condo developments in the area,” said Tanya Crepulja of Sutton Group Realty. “Condos accounted for about 1/4 of the sales in the GTA, which shows there’s high demand for this type of product.”

The only affordable area for single family homes was in Durham Region. Royal LePage Frank Real Estate sales representative Alexis Appleby said you could get a decent home for around $380,000. And the further you head east towards Oshawa, the cheaper it gets.

York Region, on the other hand, is experiencing a serious lack of inventory.

In Richmond Hill alone, last week there were only 13 freehold houses available for under $500,000 — representing 6.5% of the total number of houses on the market in that area.

“I think that paints a picture of how almost desperate the inventory situation is,” said Jim Common, sales representative for RE/MAX. “The average days on market at this price point is 15 days. There are 200 homes for sale in Richmond Hill — 66 of those are over $1 million. I think interest rates will eventually increase and that will bust the bubble.”

And prices are expected to keep climbing in 2012. According to TREB economist Jason Mercer, he predicts the average price of a home will rise to $480,000 this year.

That makes it tougher for first-time home buyers to save and bank away a down payment for a decent home.

Trellawny Graham, a 32-year-old who works in advertising, bought a house in November. She ended up purchasing a two-bedroom, 1000-square-feet home in Oshawa because that was the only area she could afford.

“I can get so much more for my money,” she said. “I find places closer to (the city) are just double or triple the price and not even as nice as mine. It sits on deep plot of land. I was able to get my house for $185,900. It was just scary to think if I’d ever find a house that I can actually afford to buy.”

Toronto real estate lawyer James Fraser said as worrisome Canada’s housing market is, it is incomparable to the U.S. because Canadian buyers and banks are both prudent.

“Our foreclosure rate has not budged at all during the recession – it’s less than 1%,” he said. “If someone’s thrown out of a job, then that’s going to be an extremely stressful situation and people could lose their houses. But I don’t see the same factors that have devastated the US housing market — I’m not seeing people get into the housing market when they can’t afford it.”

jenny.yuen@sunmedia.ca

http://www.torontosun.com/2012/01/21/toronto-real-estate-safe-as-houses

For the past seven years, the chef has made her two-bedroom corner unit at 550 Front St. W. really feel like home by gutting the kitchen, installing a quartz counter top and opening up the space.

Campbell, 65, moved west after living in a home in the Beach area, loving that she no longer has to maintain a backyard or shovel snow off a driveway.

And being a foodie, she’s close to hip restaurants along the King West strip. She’s also able to enjoy summers out in her terrace with her little chihuahua — that is, when there isn’t a dust storm from nearby construction of other condos going up along the waterfront.

But retirement is nearing for Campbell and she’s made the decision move again — to a house in the Niagara Region.

Economists forecast Toronto’s booming condo market will experience a crisis in a few years with too much supply and sagging demand, starting in 2013.

So for Campbell, this is the ideal time to sell and is listing her property at $449,800.

“In my mind, if there is that much inventory for people to choose from, would they choose (to buy) a brand-new place or a place that’s been here for a while?” she said. “I don’t want to wait to find out. I’d rather get my equity out now and move onto something else.”

Several of Canada’s biggest banks recently warned about a possible correction in the housing market. Still, prices of homes keep rising, according to the Toronto Real Estate Board (TREB) with mortgage rates remaining low, hovering around 3%.

In fact, the Economist recently declared Canada as one of nine countries where “home prices are overvalued by about 25% or more” and among four countries where prices are in line with those in the United States “at the peak of its bubble.”

While many fear Toronto’s real estate bubble is on the verge of bursting, analyst are cautioning buyers and sellers to relax.

“I do not believe that Toronto, as a whole, is in a bubble,” explains Don Campbell, president of the Real Estate Investment Network. “I think it’s more like a balloon where the air is going to start leaking out.”

Housing will continue to stay strong throughout downtown communities and surrounding areas, such as Leslieville and the Junction, where many newcomers may choose to buy homes because downtown is too expensive, Campbell said. Where there is trouble is the new condo market.

“I believe we’re going to feel an over supply in 2013 because we’ve got a record number of condos coming onto the market in 2012,” he says. “In addition, there have been a lot of development applications put forward to the City of Toronto at the end of December. We’re already starting to see a slowdown in foreign money going into the condo market.”

When those who bought new condos are handed their keys with the intention of immediately flipping the property, they’ll be others doing the same.

“Therefore, you’re going to have an oversupply of the situation come on,” Campbell adds. “That oversupply won’t last for a long time — not like the U.S. — but it’s going to keep a real cap on value.”

Craig Alexander, chief economist for TD Canada Trust, says many first-time home buyers jumped into the real estate market in 2009 because of record-low mortgage rates. The market remained strong in 2010, but it began moderating in 2011.

“I think in the coming year we’ll see the housing market pretty flat,” he predicts.

“I don’t see the likelihood of a major correction coming this year. I do think there’s over-valuation in the market, but I don’t see a major housing bubble in the GTA. I think when we see interest rates rise, we’ll see housing prices decline but it won’t be a dramatic decline.”

The big risk to the so-called bubble occurs when there’s a sharp spike in unemployment or as interest rates shoot up. Alexander figures interest rates should increase by a modest rate — 1% in 2013 and 1% in 2014.

“Torontonians need to be careful not to over-extend themselves because eventually, interest rates will rise,” he said. “I feel like the little boy that cried wolf because every year I tell people that rates could rise and then they don’t. But I always have to remind people that the wolf does show up at the end of the story.”

Richard Silver, the president of the Toronto Real Estate Board (TREB), said the seller’s market has transitioned to a balanced market with more listings now than a year ago.

“Anything that came on the market had multiple offers and buyers had to get a lot more aggressive,” he said.

“They had to get their ducks in a row — like their financing and building inspections and had to make decisions quickly. Now, buyers have more time. They can look around.”

With the new condo sales, it really depends on what is happening in foreign investors, Silver said.

“A lot of (condo deals) happen offshore … that’s a really big part of the market,” he said. “We’re very lucky in Toronto. Right now, there’s a lot of shovels going in the ground. I look at New York and there’s hardly anything being built. Yet, in Toronto, it’s gangbusters.”

TREB had second-best year on record for sales in 2011 with 89,347 — up 4% from the previous year.

According to the real estate board, $465,000 is the average price of a single-family home in 2011. So, what does that get you in the GTA? Surprisingly, not as much as you’d think.

In Toronto, that amount will get you a 800-900-sq.-ft. condo, though it will be renovated and in move-in condition.

“There was only one house that turned up (on a search) – it was on Dufferin, there were no pictures, so it would’ve been an absolute fixer-upper for $465,000,” said Kimball Sarin, a broker with Bosley Real Estate, who has been in the real estate business for a decade. “Whereas this price range for condos, you could get a decent space in move-in conditions. You can sometimes get two bedrooms.”

If you’re looking for a house in Toronto, you’ll likely have to scour Leslieville or the Junction area — places that are roughly 20 minutes outside the downtown core.

“I find people who are looking for only condos don’t even want to discuss moving outwards, they just want to be downtown,” Sarin said. “They’re mostly younger people, 20s-30s typically, first-time buyers. We’re also getting a lot of empty-nesters. People that are going to be selling a larger house.”

Catherine McIsaac, a Sutton Group sales representative, said parts of the 905 are slowly catching up with the rising prices in Toronto. The only detached property available in Oakville was a 1,500-2,000-sq.-ft. three-bedroom family home in the West Oak Trails with an unfinished basement.

In Mississauga, the Marilyn Monroe building — a unique curvy condo tower at 50 Absolute Ave. near Square One — fits in the $465,000 budget. That price fetches a two-bedroom plus den, 997-sq.-ft. unit which costs about $428,400.

With an influx of 100,000 people to the GTA each year, many renters are moving into condos purchased by offshore investors because there aren’t many developers building rental properties anymore.

“There are several new condo developments in the area,” said Tanya Crepulja of Sutton Group Realty. “Condos accounted for about 1/4 of the sales in the GTA, which shows there’s high demand for this type of product.”

The only affordable area for single family homes was in Durham Region. Royal LePage Frank Real Estate sales representative Alexis Appleby said you could get a decent home for around $380,000. And the further you head east towards Oshawa, the cheaper it gets.

York Region, on the other hand, is experiencing a serious lack of inventory.

In Richmond Hill alone, last week there were only 13 freehold houses available for under $500,000 — representing 6.5% of the total number of houses on the market in that area.

“I think that paints a picture of how almost desperate the inventory situation is,” said Jim Common, sales representative for RE/MAX. “The average days on market at this price point is 15 days. There are 200 homes for sale in Richmond Hill — 66 of those are over $1 million. I think interest rates will eventually increase and that will bust the bubble.”

And prices are expected to keep climbing in 2012. According to TREB economist Jason Mercer, he predicts the average price of a home will rise to $480,000 this year.

That makes it tougher for first-time home buyers to save and bank away a down payment for a decent home.

Trellawny Graham, a 32-year-old who works in advertising, bought a house in November. She ended up purchasing a two-bedroom, 1000-square-feet home in Oshawa because that was the only area she could afford.

“I can get so much more for my money,” she said. “I find places closer to (the city) are just double or triple the price and not even as nice as mine. It sits on deep plot of land. I was able to get my house for $185,900. It was just scary to think if I’d ever find a house that I can actually afford to buy.”

Toronto real estate lawyer James Fraser said as worrisome Canada’s housing market is, it is incomparable to the U.S. because Canadian buyers and banks are both prudent.

“Our foreclosure rate has not budged at all during the recession – it’s less than 1%,” he said. “If someone’s thrown out of a job, then that’s going to be an extremely stressful situation and people could lose their houses. But I don’t see the same factors that have devastated the US housing market — I’m not seeing people get into the housing market when they can’t afford it.”

jenny.yuen@sunmedia.ca

http://www.torontosun.com/2012/01/21/toronto-real-estate-safe-as-houses

Friday, January 20, 2012

Four fined for fishing Humber

TORONTO - It’s their turn to be caught on the end of a hook.

Four Toronto men have been fined a combined $2,500 for illegal salmon fishing on the Humber River.

The men were found on Oct. 8, snagging salmon within 25 yards of a dam on the river- an area where fishing is prohibited. Two of them did not have fishing licenses.

Each pleaded guilty to charges under the Fisheries Act and the Ontario Fishery Regulations - Richard Muntyan, Ervin Paczok, and Iles Glosczi were charged $500 each, while Tibor Danyi was charged $1000. Their fishing equipment was also permanently seized.

“The guys were very deliberately trying to catch the fish at the back of the fin to get them in,” said Jay Downer, one of the conservation officers who found the fishers. “They were casting and reeling, casting and reeling, trying to hook them anywhere but the mouth, basically.”

Luckily, they were caught before having any real success.

“We were able to bust them before they caught all of the fish,” said Downer.

Migratory fish like salmon are especially vulnerable, as they travel upstream together to spawn.

“This is something that happens pretty often in the Humber River,” said Bill Laferty, Supervisor of the Aurora Enforcement Unit. “It’s not an every day occurrence, but it does happen, so we try our best to get down there whenever we can to make sure it’s prevented.”

“It comes down to a principle of ethics,” said Downer. “Nobody should be doing this as a commercial enterprise: The idea isn’t to catch as many fish as you can, as quickly as you can.”

Laferty and Downer suggest calling in a tip to 1-877-847-TIPS (7667) if you suspect someone to be fishing illegally.

Four Toronto men have been fined a combined $2,500 for illegal salmon fishing on the Humber River.

The men were found on Oct. 8, snagging salmon within 25 yards of a dam on the river- an area where fishing is prohibited. Two of them did not have fishing licenses.

Each pleaded guilty to charges under the Fisheries Act and the Ontario Fishery Regulations - Richard Muntyan, Ervin Paczok, and Iles Glosczi were charged $500 each, while Tibor Danyi was charged $1000. Their fishing equipment was also permanently seized.

“The guys were very deliberately trying to catch the fish at the back of the fin to get them in,” said Jay Downer, one of the conservation officers who found the fishers. “They were casting and reeling, casting and reeling, trying to hook them anywhere but the mouth, basically.”

Luckily, they were caught before having any real success.

“We were able to bust them before they caught all of the fish,” said Downer.

Migratory fish like salmon are especially vulnerable, as they travel upstream together to spawn.

“This is something that happens pretty often in the Humber River,” said Bill Laferty, Supervisor of the Aurora Enforcement Unit. “It’s not an every day occurrence, but it does happen, so we try our best to get down there whenever we can to make sure it’s prevented.”

“It comes down to a principle of ethics,” said Downer. “Nobody should be doing this as a commercial enterprise: The idea isn’t to catch as many fish as you can, as quickly as you can.”

Laferty and Downer suggest calling in a tip to 1-877-847-TIPS (7667) if you suspect someone to be fishing illegally.

Friday, January 13, 2012

Vintage photographs of snow in Toronto

You could be forgiven if you had almost forgotten what Toronto looks like covered in snow until waking up this morning to see a fresh dusting

laid across the city. Although not a major snowfall event, it seems

like winter was due 'round these parts, so more than a few people will

likely welcome the precipitation despite the inconveniences that come

along with it. I'd count myself among this group, not the least of which

because I can skip making a trip into the office if I'm not up for a

messy commute.

You could be forgiven if you had almost forgotten what Toronto looks like covered in snow until waking up this morning to see a fresh dusting

laid across the city. Although not a major snowfall event, it seems

like winter was due 'round these parts, so more than a few people will

likely welcome the precipitation despite the inconveniences that come

along with it. I'd count myself among this group, not the least of which

because I can skip making a trip into the office if I'm not up for a

messy commute.Even if the last couple seasons haven't served up a whole lot of winter precipitation, it's probably fair to say that the experience of dealing with snow is still somehow crucial to understanding what life is like in Toronto. From the massive storms of 1999 and 1944 to navigating slippery streets to the simple act of shovelling, snow is hardwired into the city's historical consciousness.

For proof of this, I've put together a collection of vintage photographs of snow and snowstorms in Toronto. I intentionally kept the majority of these photos out of my look back at various winter activities in this city, believing that each deserved its own entry in our ongoing history of Toronto in photos. For those complaining about today's accumulation, some of the shots below might provide some comforting perspective on how much worse it can be.

PHOTOS

Storm damage on Brock Street, 1896

Cherry Street, 1908

Old City Hall encased in frost, 1910

Broadview near Riverdale Park, 1917

Broadview near Riverdale Park, 1917

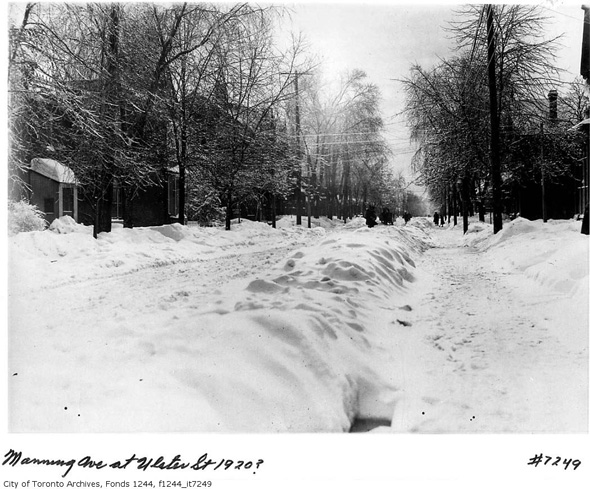

Manning and Ulster, 1920

Snowy Queen Street, 1922

Snowy Queen Street, 1924

Snow plough operated by the TTC, 1924

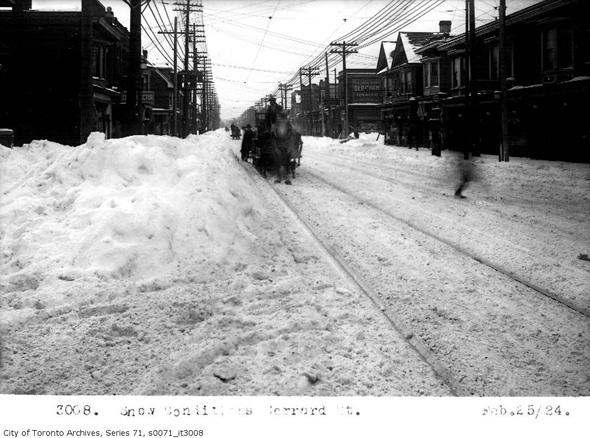

Gerrard Street, 1924

Winter pastoral in High Park, 1932

College and St. George snow removal, 1936

Barton Avenue snow removal, 1936

Snow blower, 1940s

Snow blower, 1943

The great snow storm of 1944

The city shut down, 1944

Yonge looking north at Richmond, 1944

Yonge looking north at Adelaide, 1944

Buried, 1944

George Street north to Adelaide, 1944

Good luck digging out, 1944

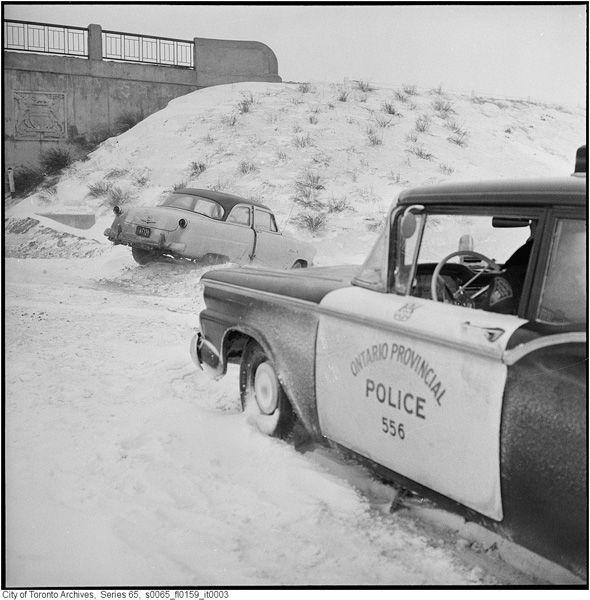

The OPP helping out on the QEW, 1960

Totally safe driving conditions, 1960

Shovelling out, 1961

Shovelling out, 1961

More shovelling, 1961

Waiting for the bus, 1961

Near King and John streets, 1961

Near King and John streets, 1961

Snow removal, 1965

Snow removal, 1965

Snow at Old Mill Station, 1965

Subscribe to:

Posts (Atom)