The environmental protections for the future Rouge National Urban Park will be less strict than those that currently exist, says a group of environmental organizations in a letter that was sent to Premier Dalton McGuinty earlier this month.

The groups are urging the provincial government to insist on five conditions before signing away large tracts of land on Toronto's eastern edge to the federal government, which will establish Canada's first urban national park.

“The draft National Park Concept is critically inconsistent with the public vision, planning, scientific and legislative framework developed over the last 23 years,” says the letter, signed by the heads of Environmental Defence, Ontario Nature and Friends of the Rouge Watershed groups.

Rouge Park is currently a hodgepodge of lands cobbled together from municipal and provincial governments totalling almost 40 square kilometres in Toronto and Markham.

The future national park will add just under 20 sq. km of federal land, but can't be established until Ontario officially cedes land to Ottawa and Parks Canada.

“The province is in a really strong position because it owns roughly two-thirds of the lands,” said Erin Shapero, land and water program manager at Environmental Defence.

The groups want Infrastructure and Transportation Minister Bob Chiarelli, who is heading the transfer process, to obtain more robust environmental guarantees for the future park.

“We want to keep the same protections that we have on the land now, and we're going to do whatever we can through the land transfer process to put conditions on the transfer,” said Shapero.

Phil Donelson, a representative from the premier's office, said the provincial government is committed to keeping strong environmental protections in place in the Rouge.

“We are actively working with the federal government to ensure environmental protections will remain at our high standard. Those discussions have been positive and are ongoing,” he said in a statement emailed to the Star.

The groups would like to see the study area of the park expanded from 57 to 100 sq. km to preserve the integrity of a wildlife corridor from Lake Ontario to the Oak Ridges Moraine.

They also want to see aboriginal and environmental groups represented on the future park's advisory board.

“It's critical that the protections that are in place today stand, and I think it's everyone's expectation that under the national park rubric we would have something even stronger,” Shapero said.

Toronto City Council unanimously adopted a motion last month that uses much of the same language urging the federal government to expand the park's study area and ensure it is “protected and flourishing as an ecosystem in perpetuity.”

The conservation group's letter also urged the province to get a guarantee from the federal government that all farming in the park will be sustainable. More than 60 per cent of the future park is slated to be leased to farmers and closed to the public.

Toronto's News, Free Daily News from the Toronto Star, Globe and Mail, Toronto Sun, National Post, CP24, CTV, Global, 640toronto, CFRB, 680 News

Thursday, December 27, 2012

Thursday, December 20, 2012

GTA new home sales fall 38%

While all eyes were looking skyward for fallout from the GTA’s

softening condo market in November, sales of new single-family homes

plummeted to lows not seen since the recession, as prices soared almost

17 per cent year over year, according to a new study.

Total new home and condo sales to the end of November this year were 16 per cent below the long-term average across the GTA. But the biggest decline — some 38 per cent — has been in the sale of detached, semi-detached and townhouses, according to a report released Wednesday by market research firm RealNet Canada.

Condo sales were down just seven per cent over historic averages for November — although they fell a whopping 59 per cent compared to the same month in 2011, the tail end of what was record year of 28,000 new condo sales across the GTA.

Three new condo launches in particular buoyed highrise sales numbers this November, says RealNet, led by Tridel’s Ten York project in the waterfront area, which is considered an important bellwether of the softening market. Some 85 per cent — 596 of 694 — of its preconstruction units put up for sale Nov. 3 sold within the month, says Tridel vice president Jim Ritchie.

The RealNet study provides some of the best evidence yet of the growing gap between what’s become, just since 2011, the tale of two housing markets across the GTA — new condos and new low-rise homes, which includes detached, semi-detached and townhouses.

The average price of low-rise homes hit a record $625,473 in November, while new condos averaged $437,264, says RealNet.

While the gap between houses and condos has traditionally averaged about $78,000, it has soared to $188,000, largely just in the last 18 months, says George Carras, president of RealNet, which provides new housing market analysis for the Building Industry and Land Development Association (BILD.)

“Sales of low-rise homes in November were the worst on record next to the gloom of November 2008, when we weren’t sure if the world’s financial system was going to hold together or not,” says Carras, citing scarcity for the fact that prices soared to the point that they, combined with tighter mortgage rules, pushed down sales in November.

The scarcity includes a shortage of develop-ready land for new subdivisions caused by a lack of municipal roads, sewers and other infrastructure, as well as the fact that thousands of hectacres of future-growth areas within the provincial greenbelt are tied up in disputes at the Ontario Municipal Board, says Carras.

That supply pressure, at the same time the GTA is seeing a “mini baby boom” among echo boomers, could push up new home prices an average 15 per cent a year, says Bryan Tuckey, president and CEO of BILD.

“In Vancouver, the gap has grown to $700,000 between a condo and a detached house. Vancouver is about 15 years ahead of Toronto in terms of the maturity of its intensification policies and their impacts,” says Carras.

“That city is between the water and the mountains. Here we’re between the water and policy mountains and the same impact is starting to show.”

But John Stillich, former executive director of the Sustainable Urban Development Association, says too many developers remain fixated on the two extremes of new housing — high- and low-rise — instead of a new middle ground of two- or three-storey housing types that allows GTA residents to “live sustainably on the lands that we do have.”

“It’s not about a scarcity of land. It’s about how you use the land. The development industry could probably build twice as many ground-related houses if they started thinking in a completely different way.”

Total new home and condo sales to the end of November this year were 16 per cent below the long-term average across the GTA. But the biggest decline — some 38 per cent — has been in the sale of detached, semi-detached and townhouses, according to a report released Wednesday by market research firm RealNet Canada.

Condo sales were down just seven per cent over historic averages for November — although they fell a whopping 59 per cent compared to the same month in 2011, the tail end of what was record year of 28,000 new condo sales across the GTA.

Three new condo launches in particular buoyed highrise sales numbers this November, says RealNet, led by Tridel’s Ten York project in the waterfront area, which is considered an important bellwether of the softening market. Some 85 per cent — 596 of 694 — of its preconstruction units put up for sale Nov. 3 sold within the month, says Tridel vice president Jim Ritchie.

The RealNet study provides some of the best evidence yet of the growing gap between what’s become, just since 2011, the tale of two housing markets across the GTA — new condos and new low-rise homes, which includes detached, semi-detached and townhouses.

The average price of low-rise homes hit a record $625,473 in November, while new condos averaged $437,264, says RealNet.

While the gap between houses and condos has traditionally averaged about $78,000, it has soared to $188,000, largely just in the last 18 months, says George Carras, president of RealNet, which provides new housing market analysis for the Building Industry and Land Development Association (BILD.)

“Sales of low-rise homes in November were the worst on record next to the gloom of November 2008, when we weren’t sure if the world’s financial system was going to hold together or not,” says Carras, citing scarcity for the fact that prices soared to the point that they, combined with tighter mortgage rules, pushed down sales in November.

The scarcity includes a shortage of develop-ready land for new subdivisions caused by a lack of municipal roads, sewers and other infrastructure, as well as the fact that thousands of hectacres of future-growth areas within the provincial greenbelt are tied up in disputes at the Ontario Municipal Board, says Carras.

That supply pressure, at the same time the GTA is seeing a “mini baby boom” among echo boomers, could push up new home prices an average 15 per cent a year, says Bryan Tuckey, president and CEO of BILD.

“In Vancouver, the gap has grown to $700,000 between a condo and a detached house. Vancouver is about 15 years ahead of Toronto in terms of the maturity of its intensification policies and their impacts,” says Carras.

“That city is between the water and the mountains. Here we’re between the water and policy mountains and the same impact is starting to show.”

But John Stillich, former executive director of the Sustainable Urban Development Association, says too many developers remain fixated on the two extremes of new housing — high- and low-rise — instead of a new middle ground of two- or three-storey housing types that allows GTA residents to “live sustainably on the lands that we do have.”

“It’s not about a scarcity of land. It’s about how you use the land. The development industry could probably build twice as many ground-related houses if they started thinking in a completely different way.”

Wednesday, December 12, 2012

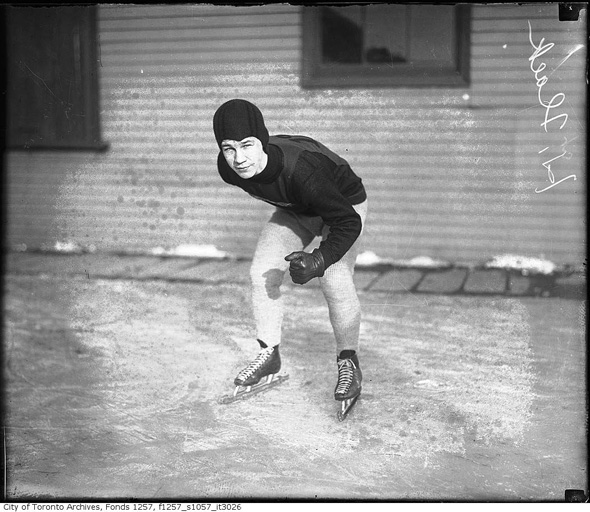

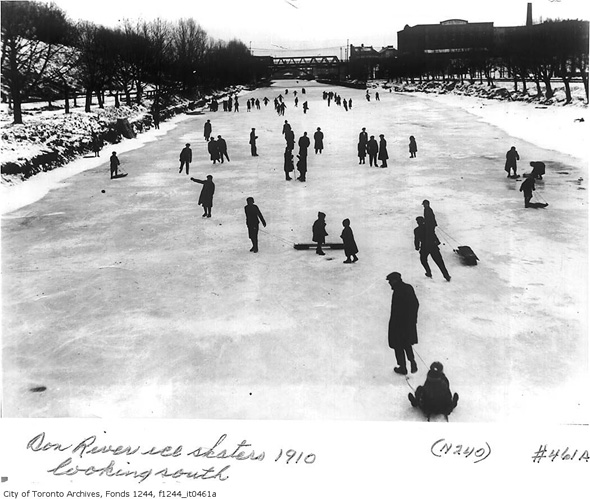

Vintage photos of winter sports in Toronto

Winter in Toronto can be the pits depending on your disposition. I know more than a few people who pseudo-hibernate during the season's coldest periods — and who can really blame them? Forgetting the mildness of last year, it tends to get rather unwelcoming out there. Our forebearers, it would appear were a braver bunch. The Toronto Archives are littered with photos of city-folk out and about in the ice and snow making the most the cold weather.

And while most of the things they got up to remain familiar to us — there's hockey, skiing and tobogganing, of course — other activities like ice-boating have disappeared over the years, despite the fact that they look like they were a whole lot of fun. The inner harbour was a more active recreational space when it was guaranteed to freeze over. That time has passed, but we still have the photos.

Ice boating!

Ice-boating on the inner harbour

Ice-boating on the inner harbourOutdoor skating

While outdoor skating remains popular, the venues are decidedly less pretty

Tobogganing

Torontonians used to take their tobogganing very seriously (check out the one with the light on it!)

Torontonians used to take their tobogganing very seriously (check out the one with the light on it!)Hockey

You didn't need artificial ice back then...

Skiing

Urban skiing was a far more common site in the 1920s

Curling

Outdoor curling!

Ice fishing

Why dress down to ice fish?

And, naturally, snowball fights

Some things never get old...

Wednesday, December 5, 2012

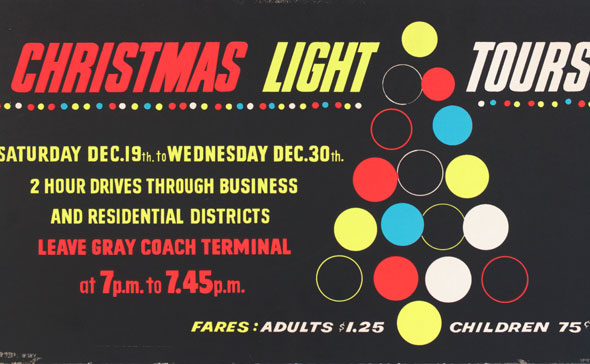

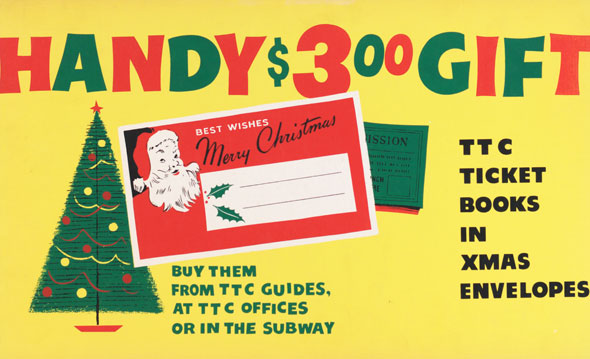

Get into the holiday spirit with vintage TTC ads

Though some of its staff might occasionally be lacking in the charm department, the TTC was once a perennial source of thoroughly endearing artwork and ideas. In the 1950s, the Commission not only published beautifully illustrated etiquette suggestions for its riders, when December rolled around it wished them a merry Christmas too (this being the '50s, there wasn't a whole lot of attention paid to non-Christian holiday celebrations).

Several of these cards were hung in the advertising gantry around the inside of PCC streetcars at the time the city was preparing to launch its first subway line. The drawings prominently featured a hard-working Santa Claus helping hoist steel girders and popping out of the wooden street cover with a pickaxe and shovel on his back.

The vaguely constructivist style shows the optimism that surrounded the coming modern era of rapid transit and gives an insight into the mentality of the TTC at the time, that is to say a sense of pride and excitement for the future. They were building a better city, and everyone would benefit.

The festivities weren't limited to happy artwork. Each year a special bus service toured the city's best Christmas illuminations in the downtown core and residential streets, giving eager onlookers a chance to see parts of the city they might not otherwise be able to visit. Special commemorative tickets and token holders were also part of the seasonal fare.

Enjoy these little pieces of nostalgia and think back to a time when a dusting of snow all it took to make the city look convivial and calm.

MORE IMAGES:

Images: City of Toronto Archives

Biggest property tax increases expected in Davenport, Willowdale neighbourhoods

Homeowners in the Davenport and Willowdale neighbourhoods will

likely end up paying more property tax next year, based on recent

assessments.

But they’re also the neighbourhoods with the highest increases in property values.

“Our values are consistent with the trends and patterns in the real estate market,” said Joe Regina, with the Municipal Property Assessment Corp. which assesses properties across the province. “These are generally in high demand (and) it’s outpacing their supply.”

Parkdale-High Park, Trinity-Spadina, Rosedale, Davenport and Willowdale all came in well above the average 22.8-per-cent increase in the value of city homes since 2008.

The assessments, which are done every four years, will be used to calculate property taxes in 2013. To cushion the impact, the increased assessments are phased in over four years, with the average assessment going up 5.5 per cent per year to reach the full amount in 2016.

The key to determining a tax bill is where a property ranks with respect to the average in the municipality. If the increase in assessment has been above average, the homeowner will see a tax increase; if it’s average there will be no change; and if it’s below average, the resident will get a tax decrease.

Homeowners in hot real estate neighbourhoods are at highest risk of seeing their property taxes go up in 2013.

Davenport ranked highest out of Toronto’s 44 wards with an increase of 33.72 per cent. Wards 23 and 24, both in Willowdale, were the next highest with 31.44 per cent and 29.56 per cent increases, respectively.

Property assessments in Trinity-Spadina rose 29.25 per cent, Rosedale jumped 28.73 per cent, and Parkdale-High Park was up 27.03 per cent. Rouge River in Scarborough recorded a 27.41-per-cent jump in assessed value.

Wards in North Etobicoke, Centre Etobicoke and York West were well below the average. Assessed value of York West properties increased 13.98 per cent (Ward 8) and 14.97 per cent (Ward 7). In Etobicoke North they rose 15 per cent (Ward 1) and 16.03 per cent (Ward 2), while Etobicoke Centre wards increased 16.64 per cent (Ward 3) and 17.39 per cent (Ward 4).

Due to the variety of buyers in the market it’s hard to pinpoint what areas will be hot, however neighbourhoods in the vicinity of the subway lines are popular for first-time buyers, said John Pasalis, president of Realosophy Realty.

“These areas are most affordable,” Pasalis said. “Neighbourhoods like the Dovercourt area, they’ll be popular.

An area with houses around $600,000 or close to downtown and near the subway will be in high demand, Pasalis said, adding some areas in the east end, like Leslieville, remain affordable, but he imagines that won’t last long.

The Toronto Real Estate Board home index lists the Junction Triangle/High Park area as having the highest increase in house values measured over five years — not four, like MPAC — at 41.77 per cent.

Pasalis said “blue chip” areas will remain in high demand for second-time buyers and families looking to upgrade and focus on quality schooling.

“Davisville, Riverdale, the Beach, they’re still within reach for most second-time buyers,” he said. Houses in the $750,000 to $850,000 range are still available to dual-income families with kids in those areas, he added.

Sales in condo-centric areas like Liberty Village and City Place will slow in the coming years, Pasalis said.

If the market cools and prices begin to dip, condo owners looking to upgrade to something bigger might be caught in a tough spot, he said.

“Some young condo owners are buying houses first before selling their condos and they end up being in a pinch if it doesn’t sell on time,” he said. “It’s already starting to create challenges for some people, and I think that’s going to continue.

But they’re also the neighbourhoods with the highest increases in property values.

“Our values are consistent with the trends and patterns in the real estate market,” said Joe Regina, with the Municipal Property Assessment Corp. which assesses properties across the province. “These are generally in high demand (and) it’s outpacing their supply.”

Parkdale-High Park, Trinity-Spadina, Rosedale, Davenport and Willowdale all came in well above the average 22.8-per-cent increase in the value of city homes since 2008.

The assessments, which are done every four years, will be used to calculate property taxes in 2013. To cushion the impact, the increased assessments are phased in over four years, with the average assessment going up 5.5 per cent per year to reach the full amount in 2016.

The key to determining a tax bill is where a property ranks with respect to the average in the municipality. If the increase in assessment has been above average, the homeowner will see a tax increase; if it’s average there will be no change; and if it’s below average, the resident will get a tax decrease.

Homeowners in hot real estate neighbourhoods are at highest risk of seeing their property taxes go up in 2013.

Davenport ranked highest out of Toronto’s 44 wards with an increase of 33.72 per cent. Wards 23 and 24, both in Willowdale, were the next highest with 31.44 per cent and 29.56 per cent increases, respectively.

Property assessments in Trinity-Spadina rose 29.25 per cent, Rosedale jumped 28.73 per cent, and Parkdale-High Park was up 27.03 per cent. Rouge River in Scarborough recorded a 27.41-per-cent jump in assessed value.

Wards in North Etobicoke, Centre Etobicoke and York West were well below the average. Assessed value of York West properties increased 13.98 per cent (Ward 8) and 14.97 per cent (Ward 7). In Etobicoke North they rose 15 per cent (Ward 1) and 16.03 per cent (Ward 2), while Etobicoke Centre wards increased 16.64 per cent (Ward 3) and 17.39 per cent (Ward 4).

Due to the variety of buyers in the market it’s hard to pinpoint what areas will be hot, however neighbourhoods in the vicinity of the subway lines are popular for first-time buyers, said John Pasalis, president of Realosophy Realty.

“These areas are most affordable,” Pasalis said. “Neighbourhoods like the Dovercourt area, they’ll be popular.

An area with houses around $600,000 or close to downtown and near the subway will be in high demand, Pasalis said, adding some areas in the east end, like Leslieville, remain affordable, but he imagines that won’t last long.

The Toronto Real Estate Board home index lists the Junction Triangle/High Park area as having the highest increase in house values measured over five years — not four, like MPAC — at 41.77 per cent.

Pasalis said “blue chip” areas will remain in high demand for second-time buyers and families looking to upgrade and focus on quality schooling.

“Davisville, Riverdale, the Beach, they’re still within reach for most second-time buyers,” he said. Houses in the $750,000 to $850,000 range are still available to dual-income families with kids in those areas, he added.

Sales in condo-centric areas like Liberty Village and City Place will slow in the coming years, Pasalis said.

If the market cools and prices begin to dip, condo owners looking to upgrade to something bigger might be caught in a tough spot, he said.

“Some young condo owners are buying houses first before selling their condos and they end up being in a pinch if it doesn’t sell on time,” he said. “It’s already starting to create challenges for some people, and I think that’s going to continue.

Condos take the biggest hit as home sales drop in the GTA

Home sales continue to slide and

prices soften, especially in the 416 region, according to the Toronto

Real Estate Board, which recorded a 16 per cent decline in sales

compared with November, 2011.

Condos took the biggest hit with resale transactions down 25.5 per cent across the GTA and prices down an average of 2.3 per cent. The biggest declines in condo prices were in the City of Toronto, where they were down almost 4 per cent year over year.

Overall, resale house prices held relatively steady across the GTA, up 1.6 per cent year-over-year to an average of $485,328. But that’s a far cry from the boom days and bidding wars that defined the market up until last spring, with ‘for sale’ signs now gracing front lawns an average of 30 days.

“Transactions have been down on a year-over-year basis since June, after being up substantially in the last half of 2011 and the first half of 2012,” Toronto Real Estate Board President Ann Hannah said in releasing the monthly statistics Wednesday.

“Some buyers pulled forward their decision to purchase, which has impacted sales levels in the second half of 2012.”

Once again, TREB attributed tougher mortgage lending rules — especially the capping of amortizations at 25 years instead of 30 years — and the City of Toronto’s land transfer tax for pushing many buyers to the sidelines.

But also impacting average price growth has been a shift away from pricier homes, says TREB.

“The share of detached homes that sold for over one-million dollars was down substantially, which influenced the overall average price,” says Jason Mercer, TREB’s senior manager of market analysis.

The number of detached homes that changed hands this November compared with November, 2011 was down 13 per cent across the GTA — a drop in sales of 18.5 per cent in the City of Toronto and 10.6 per cent in the 905 regions.

Prices for detached homes were down almost 4 per cent in the City of Toronto, but up 3.5 per cent in the 905 regions, according to the TREB figures, and averaged $741,480 and $556,745 respectively.

Sales of previously owned condos sank by 25.1 per cent in the City of Toronto and 26.5 per cent in the 905 regions. Prices were down 3.9 per cent in the City of Toronto and up 2.5 per cent in the 905 regions over last November, with prices averaging $350,540 and $279,483 respectively.

Semi-detached homes saw an 11 per cent drop in sales, especially in the City of Toronto. But prices held up better in that market segment than all others, with prices up 5.8 per cent in the 905 regions to average $392,067, and 3.8 per cent in the City of Toronto to an average price of $583,117 in November.

Townhouse sales were down 13.6 per cent overall across the GTA, with the biggest decline recorded in the City of Toronto, where sales were off more than 28 per cent. Average prices were up 5.3 per cent in the 416 region to $440,930 and 1.3 per cent in the 905 regions to an average of $347,461.

New MLS listings were up slightly year-over-year, with 9,838 homes for sale across the GTA last month. A total of almost 5,800 homes changed hands across the GTA in November, down from 6,908 a year earlier.

Condos took the biggest hit with resale transactions down 25.5 per cent across the GTA and prices down an average of 2.3 per cent. The biggest declines in condo prices were in the City of Toronto, where they were down almost 4 per cent year over year.

Overall, resale house prices held relatively steady across the GTA, up 1.6 per cent year-over-year to an average of $485,328. But that’s a far cry from the boom days and bidding wars that defined the market up until last spring, with ‘for sale’ signs now gracing front lawns an average of 30 days.

“Transactions have been down on a year-over-year basis since June, after being up substantially in the last half of 2011 and the first half of 2012,” Toronto Real Estate Board President Ann Hannah said in releasing the monthly statistics Wednesday.

“Some buyers pulled forward their decision to purchase, which has impacted sales levels in the second half of 2012.”

Once again, TREB attributed tougher mortgage lending rules — especially the capping of amortizations at 25 years instead of 30 years — and the City of Toronto’s land transfer tax for pushing many buyers to the sidelines.

But also impacting average price growth has been a shift away from pricier homes, says TREB.

“The share of detached homes that sold for over one-million dollars was down substantially, which influenced the overall average price,” says Jason Mercer, TREB’s senior manager of market analysis.

The number of detached homes that changed hands this November compared with November, 2011 was down 13 per cent across the GTA — a drop in sales of 18.5 per cent in the City of Toronto and 10.6 per cent in the 905 regions.

Prices for detached homes were down almost 4 per cent in the City of Toronto, but up 3.5 per cent in the 905 regions, according to the TREB figures, and averaged $741,480 and $556,745 respectively.

Sales of previously owned condos sank by 25.1 per cent in the City of Toronto and 26.5 per cent in the 905 regions. Prices were down 3.9 per cent in the City of Toronto and up 2.5 per cent in the 905 regions over last November, with prices averaging $350,540 and $279,483 respectively.

Semi-detached homes saw an 11 per cent drop in sales, especially in the City of Toronto. But prices held up better in that market segment than all others, with prices up 5.8 per cent in the 905 regions to average $392,067, and 3.8 per cent in the City of Toronto to an average price of $583,117 in November.

Townhouse sales were down 13.6 per cent overall across the GTA, with the biggest decline recorded in the City of Toronto, where sales were off more than 28 per cent. Average prices were up 5.3 per cent in the 416 region to $440,930 and 1.3 per cent in the 905 regions to an average of $347,461.

New MLS listings were up slightly year-over-year, with 9,838 homes for sale across the GTA last month. A total of almost 5,800 homes changed hands across the GTA in November, down from 6,908 a year earlier.

Toronto’s city-owned theatres struggling to make ends meet

Taxpayers are being asked to dig deeper to subsidize Toronto’s three

city-owned theatres because business is down, council’s budget committee

was told Tuesday.

In total, the three theatres are looking to taxpayers to write a cheque for $4.3 million to cover them for 2013.

One of the theatres, the Sony Centre, is hosting corporate events and weddings to make ends meet. Still, it’s seeking a 35.8-per-cent increase in its subsidy, to $1.2 million in 2013.

The Toronto Centre for the Arts in North York, which suffered a loss when theatre producer Dancap Productions departed the Main Stage, wants a 96.5-per-cent subsidy increase, bringing it to $1.6 million.

And the St. Lawrence Centre for the Arts, whose tenant Canadian Stage Co. has suffered declining audiences, is requesting a 16.4-per-cent subsidy hike to $1.4 million.

The situation had Councillor James Pasternak, a budget committee member, asking if live theatre has a future in Toronto.

“I am optimistic but I think it’s going to be another five to six years before it turns around,” said Dan Brambilla, CEO of the Sony Centre, which several years ago lost the Canadian Opera Company and National Ballet of Canada to the Four Seasons Centre for the Performing Arts.

The Sony Centre opened its doors 52 years ago. The O’Keefe Centre, as it was then called, welcomed its first patrons with a performance of Camelot featuring Julie Andrews, Richard Burton and Robert Goulet.

In 1996, the venue was renamed the Hummingbird Centre. And in 2007, as part of a 10-year, $20-million partnership with Sony Canada, it took the entertainment giant’s name.

The St. Lawrence Centre was built in 1967, one of many projects tied to the Canadian Centennial. The Toronto Centre for the Arts opened in 1993.

The city had issued a formal call for interested buyers but a report concluded that the Sony Centre was the only one likely to sell. Council was advised to defer the recommendation to sell Sony Centre until early 2013.

Pasternak also asked about renting the space for non-theatrical purposes to garner revenue and was told Sony already rents out for corporate meetings and social functions.

“Corporate events are becoming a major part of our business,” Brambilla said. “We even do weddings and bar mitzvahs now, anything that we can do to make the facility useful and be profitable and bring in money.”

The Sony Centre has put a special focus on snagging part of the business from visiting conventions, conferences and trade shows, he added.

“We have a staff that sells into that market and we work with Tourism Toronto to find appropriate events coming in that we can be a host venue for. We aggressively market in that area.”

Councillor Doug Ford, the budget committee’s vice-chair, grilled the theatre representatives on the number of managers to staff.

Ford also wanted to know how many managers in the three theatres earn more than $100,000, and was told the Sony Centre and Toronto Centre each have three and the St. Lawrence Centre has one.

In total, the three theatres are looking to taxpayers to write a cheque for $4.3 million to cover them for 2013.

One of the theatres, the Sony Centre, is hosting corporate events and weddings to make ends meet. Still, it’s seeking a 35.8-per-cent increase in its subsidy, to $1.2 million in 2013.

The Toronto Centre for the Arts in North York, which suffered a loss when theatre producer Dancap Productions departed the Main Stage, wants a 96.5-per-cent subsidy increase, bringing it to $1.6 million.

And the St. Lawrence Centre for the Arts, whose tenant Canadian Stage Co. has suffered declining audiences, is requesting a 16.4-per-cent subsidy hike to $1.4 million.

The situation had Councillor James Pasternak, a budget committee member, asking if live theatre has a future in Toronto.

“I am optimistic but I think it’s going to be another five to six years before it turns around,” said Dan Brambilla, CEO of the Sony Centre, which several years ago lost the Canadian Opera Company and National Ballet of Canada to the Four Seasons Centre for the Performing Arts.

The Sony Centre opened its doors 52 years ago. The O’Keefe Centre, as it was then called, welcomed its first patrons with a performance of Camelot featuring Julie Andrews, Richard Burton and Robert Goulet.

In 1996, the venue was renamed the Hummingbird Centre. And in 2007, as part of a 10-year, $20-million partnership with Sony Canada, it took the entertainment giant’s name.

The St. Lawrence Centre was built in 1967, one of many projects tied to the Canadian Centennial. The Toronto Centre for the Arts opened in 1993.

The city had issued a formal call for interested buyers but a report concluded that the Sony Centre was the only one likely to sell. Council was advised to defer the recommendation to sell Sony Centre until early 2013.

Pasternak also asked about renting the space for non-theatrical purposes to garner revenue and was told Sony already rents out for corporate meetings and social functions.

“Corporate events are becoming a major part of our business,” Brambilla said. “We even do weddings and bar mitzvahs now, anything that we can do to make the facility useful and be profitable and bring in money.”

The Sony Centre has put a special focus on snagging part of the business from visiting conventions, conferences and trade shows, he added.

“We have a staff that sells into that market and we work with Tourism Toronto to find appropriate events coming in that we can be a host venue for. We aggressively market in that area.”

Councillor Doug Ford, the budget committee’s vice-chair, grilled the theatre representatives on the number of managers to staff.

Ford also wanted to know how many managers in the three theatres earn more than $100,000, and was told the Sony Centre and Toronto Centre each have three and the St. Lawrence Centre has one.

Tuesday, December 4, 2012

What Harbord Street used to look like in Toronto

Harbord may seem like an underwhelming street to give the historical photo treatment to, but when you consider its transformation from a mostly quiet residential street into a crucial passage through U of T and a bonafide business strip west of Spadina, there's more than enough intrigue in its past to warrant a closer look. Going back a century, Harbord was a narrow thoroughfare cutting between St.

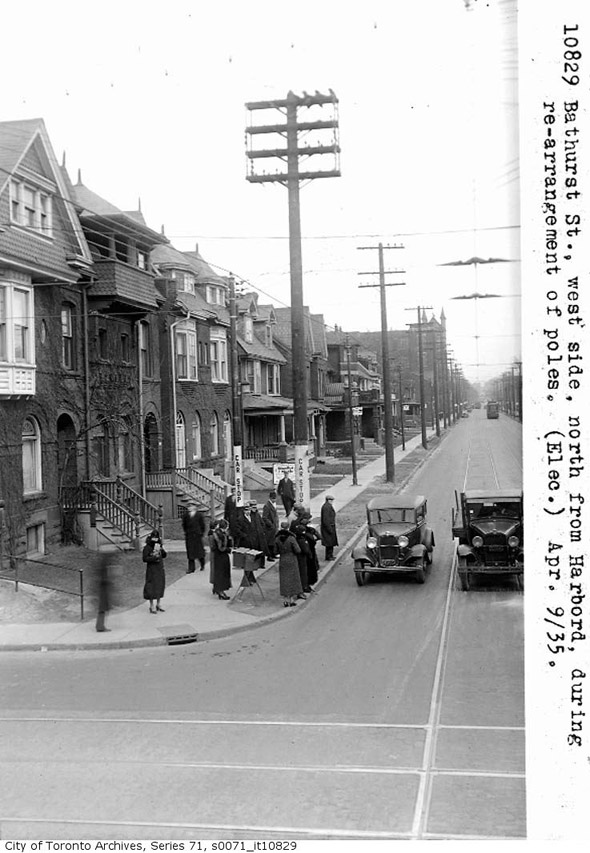

George and Ossington, anchored by Harbord Collegiate Institute in the west and the burgeoning U of T campus in the east. Street widening efforts in the early 1910s brought streetcars to the area and the first wave of commercial business, which has been preserved in the bustling stretch between Spadina and Bathurst streets.

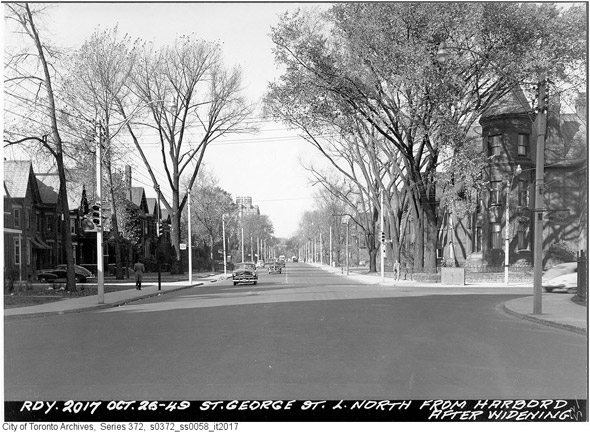

Prior to the turn of the 20th Century, the area around St. George and Harbord — now a highly trafficked intersection with U of T students coming and going from one of the city's most notorious examples of Brutalist architecture, Robarts Library — was mostly residential in nature. A second wave of street widening in the late 1940s ushered in drastic changes to this stretch of Harbord, which culminated in the construction of the library in 1973.

Looking east from Spadina in 1944, the street bears almost no resemblance to its current state. Narrow and densely packed with trees, there's a sort of lazy quality about it that has been lost to the expansion of the university and the rise of large-scale buildings in the area. U of T has always had a gorgeous downtown campus, but it was really something back then. One wouldn't even consider walking around without leather patches on his suit jacket.

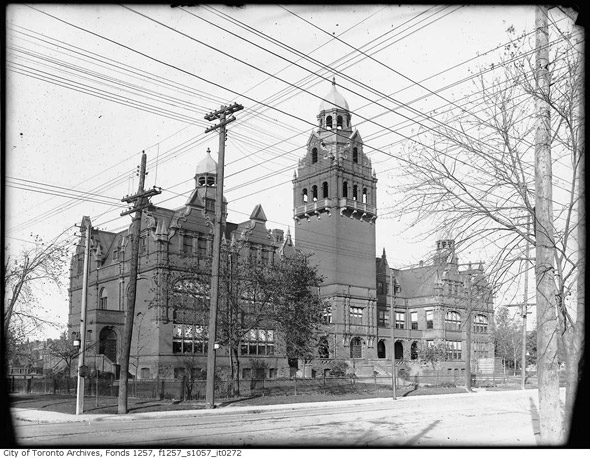

But U of T isn't, of course, the only prominent educational institution that graces Harbord Street. Both Central Tech and Harbord Collegiate have been staples since the western stretch of the street was still populated with farmland. Built in 1892, Harbord Collegiate was the first major building to be constructed on this section of the street. In honour of the school's hundredth anniversary, a group of alumni put together a sprawling history of the institution, which, despite dry moments, is certainly worth a skim. Also worthy of note regarding the school is just what a glorious building it used to housed in. What a roof!

Heading a bit further west, one encounters a bit of (mostly) buried Harbord history. The Harbord Street Bridge was constructed in the early 1910s to span the remains of the Garrison creek. Unlike the Crawford Street Bridge, which was buried entirely, the north railing of the Harbord Bridge was left above ground, so as to mark the presence of the lost structure below. It's one of those small examples of Toronto history that's easy to miss if you don't know about it, but at least somewhat satisfying to know about as you pass over it.

PHOTOS

Harbord between Spadina and Robert, 1899

Harbord Bridge under construction, 1910

Harbord Bridge nearing completion, 1910

Grace Street and Harbord Bridge in the distance, 1910

Harbord west from Spadina, 1911

Harbord looking west to Borden, 1911

Harbord looking west from Spadina, 1911

Spadina and Harbord, 1911

Intersection of Harbord, Hoskins and St. George, 1913

Intersection of Harbord, Hoskins and St. George, 1913

Harbord west of Spadina, 1913

Harbord and Palmerston, 1914

Harbord and Clinton, 1915

Central Technical School, 1920s

Harbord Collegiate, 1920s (wow, check out the roof)

Bathurst and Harbord, 1935

St. George and Harbord (pre-Robarts), 1944

Harbord and St. George, post-street widening, 1949

Looking south at the same intersection

Harbord and Spadina in the 1990s

Photos from the Toronto Archives

Subscribe to:

Posts (Atom)